- Via Panfilo Castaldi di fronte al civico 35, Milano

- 02 29407503

Test

31 Luglio 2020Prescription Drugs to Stop Drinking Alcohol Get Help Now: 877-855-3470

4 Agosto 2020Contract Assets and Contract Liabilities IFRS 15

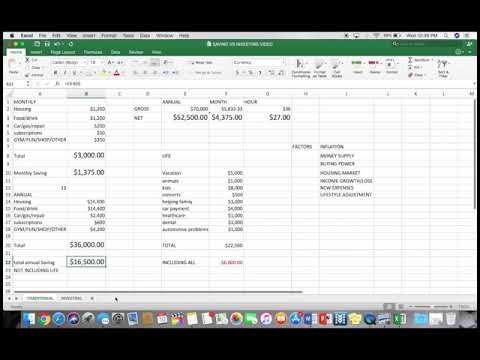

Accrual liabilities only occur when the business follows the Accrual accounting system. In February, the company receives the invoice from E&Y for an amount of $32,500. Upon paying the invoice in full, the company’s accountant records the additional audit fee expenses of $2,500 by debiting the expense account and crediting cash. He also makes a reversing entry to cancel the accrued liability of $30,000 by debiting the liability and crediting cash.

For example, they may consist of late payment charges that companies incur infrequently. Accrued liabilities are recorded in the books of accounts at the end of the accounting period, and they are reversed in the period when they are paid. It is like a temporary account created in the books of accounts. You might be thinking that accrued liabilities sound a whole lot like accounts payable.

Accrued Liabilities vs. Accounts Payable

This is also known as the Balance Sheet Equation & it forms the basis of the double-entry accounting system. Bad debt expense is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible. Since you’re preparing the income statement on Dec. 31 before your phone bill arrives, you’ll have to estimate that particular expense.

It is based on the accounting equation that states that the sum of the total liabilities and the owner’s capital equals the total assets of the company. Other examples of accrued liabilities are accrued payroll taxes and warranty costs, which are considered routine. Since you won’t pay the expense right away, the amount will be accrued towards your phone expense. It will appear under current liabilities on your balance sheet because it needs to be paid in the short-term . Analogous entries are made every month which results in the contract asset being fully transferred to receivables and repaid by the customer. Accrued Liabilitiesmeans the Seller’s accounts payable, other current liabilities and accrued liabilities.

An accrued expense, also known as an accrued liability, is an accounting term that refers to an expense that is recognized on the books before it has been paid. The expense is recorded in the accounting period in which it is incurred. Since accrued expenses represent a company’s obligation to make future cash payments, they are shown on a company’s balance sheet as current liabilities. An accrued expense can be an estimate and differ from the supplier’s invoice that will arrive at a later date. Following the accrual method of accounting, expenses are recognized when they are incurred, not necessarily when they are paid. One example of an accrued liability is accrued interest expense.

A second journal entry must then be prepared in the following period to reverse the entry. An accrued expense, also known as accrued liabilities, is an accounting term that refers to an expense that is recognized on the books before it has been paid. This is then reversed when the next accounting period begins and the payment is made.

Having good knowledge and control of your business’s finances is vital. When using the accrual form of accounting, you should always make sure that you have accrued all expenses in the correct time period. It’s very common for businesses to make an order and receive the goods or services before paying for them. At the end of an agreed-upon financial period, the business will receive a bill for what they have received. There are two types of liabilities that a business using this method of accounting must account for. Accrued liabilities are only used with the accrual method of accounting.

What is asset? Definition, Explanation, Types, Classification, Formula, and Measurement

The amount you paid will still be recorded as an expense on your income statement, but since you’ve paid the bill, it’s no longer an accrued liability. A simple sales tax accrued liability transaction might start with a sale that came with a $13.40 sales tax charge. You collect $13.40 from the customer to cover the sales tax. Since you haven’t paid that tax yet, you include it on your accounting software as an accrued liability in the “sales taxes payable” category. Then, at the end of the year or quarter, you pay this sales tax, along with any other sales taxes collected throughout the period. At that point, the $13.40 can be removed from the accrued liabilities.

One-off purchases of goods or services availed of can be termed in this category. Certain professional services such as outsourced accounting, auditing, and bookkeeping are often paid with delayed terms. We’ll take a closer look at the definition, types, and give you an example of this accounting term. So that you can get a deeper understanding of your business. Accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out.

- Meanwhile, various liabilities will be credited to report the increase in obligations at the end of the year.

- Accrual accounting is also in compliance with the US GAAP rules.

- This liability is non-routine because this is a one-time infrequent purchase, and it’s accrued because you haven’t received the bill yet.

- Creditors send invoices or bills, which are documented by the receiving company’s AP department.

Two common types of accrued liabilities concern sales taxes and payroll taxes. These costs accrue—meaning the amounts accumulate over time—and then they are paid. DrExpenseCrAccrued liabilitiesThe other stage in accounting for accrued liabilities is when companies pay for them. As stated above, companies only create these liabilities when an expense occurs. When they eventually do so, they must eliminate the accrued liability created before.

Examples would include accrued wages payable, accrued sales tax payable, and accrued rent payable. A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future. Prepaid expenses are initially recorded as assets, but their value is expensed over time onto the income statement. Unlike conventional expenses, the business will receive something of value from the prepaid expense over the course of several accounting periods. Because the company actually incurred 12 months’ worth of salary expenses, an adjusting journal entry is recorded at the end of the accounting period for the last month’s expense. The adjusting entry will be dated Dec. 31 and will have a debit to the salary expenses account on the income statement and a credit to the salaries payable account on the balance sheet.

Types of Accrued Liabilities

Accounts payable are due within the same accounting period, usually, less than a year. Accrued liabilities and payables differ with their billing methods. Accruals can be recorded before they are billed by the seller of a service or product. In our example above, the company receiving accounting services records an accrual liability on the 1st of September as soon as it realizes the expense. Accrued expenses or liabilities become an obligation for a business.

Accrued Liabilities: Definition, Journal Entry, Examples

If a company has a loan, then the interest paid upon it can be considered an accrued liability. This is because interest payments tend to be paid either monthly or annually. Infrequent/Non-Routine is the opposite and does not occur as a normal operational part of the business. An example is a one-off purchase from a supplier where a bill is not immediately received. As the event isn’t recurring, it is considered an infrequent/non-routine accrued liability.

These are recorded in the financial statements during one period and reversed in the next period. It will allow the expense incurred to be charged at the accurate price when payment is made in full. Accrued liabilities, which are also called accrued expenses, only exist when using an accrual method of accounting.

Routine/Recurring occurs as a normal operational expense of the business. An example would be accrued wages, as a company knows they have to periodically pay their employees. Under the matching principle, all expenses need to be recorded in the period they are incurred to accurately reflect financial performance. Accounting PeriodAccounting Period refers to the period in which all financial transactions are recorded and financial statements are prepared.

Let us understand the different terminologies through which accrued liabilities accounting is carried out through the explanation below. An accrued liability appears in the balance sheet, usually in the current liabilities section, accrued liabilities meaning until it has been reversed and therefore eliminated from the balance sheet. Most accrued liabilities are created as reversing entries, so that the accounting software automatically cancels them in the following period.

Even when these transactions are only recorded for accounting purposes, they must be settled at a later date. Unlike accounts payables, the settlement date for these liabilities is often undecided. Accrued liabilities are different from accounts payable for a business. A business following cash accounting does not record accrued liabilities.

An accrued liability is an obligation that an entity has assumed, usually in the absence of a confirming document, such as a supplier invoice. The most common usage of the concept is when a business has consumed goods or services provided by a supplier, but has not yet received an invoice from the supplier. The purpose of an accrued liability entry is to record an expense or obligation in the period when it was incurred. Accrued liabilities are the actual liabilities, the benefit against which is received by the business, but they are not yet paid. For example, services of the employees have been received, but their salary is yet to be paid, or goods have been received, but payment is yet to be made. If we don’t record such expenses in our books, it will not reflect an accurate financial picture of the company’s business.

Accrued expenses are recognized on the books when they are incurred, not when they are paid. Accounts payable are the invoices raised by suppliers for products or services delivered. Accounting EquationAccounting Equation is the primary accounting principle stating that a business’s total assets are equivalent to the sum of its liabilities & owner’s capital.

While there is no accrued liabilities/expenses record-keeping in the cash accounting method. With an accrual method of accounting in place, all of the business’s expenses are recorded in financial statements. These are recorded in the period of time in which they are incurred.